401k calculator with over 50 catch up

If you are 50 years of age or older and are already contributing the maximum amount permitted by your plan you can contribute up to an additional 6000 annually. The maximum catch-up contribution available is 6500 for 2022.

Solo 401k Contribution Limits And Types

The IRA catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains 1000.

. 2022 There is an alternative limit for governmental 457b participants who are in one of the three full calendar years prior to retirement age. Participants who are 49 and younger may save 20500 but those over 50 are. The annual 401k contribution limit for 2021 is 19500.

The 401k catch-up contribution limit remains the same in 2022 at 6500 for most plans and 3000 for SIMPLE 401ks. For those age 50 or over who are making catch-up contributions the limits are 26000 in 2020 an additional 6500 allowed. Gain Access to a Wide Range of Investment Options When you Transfer To a Fidelity IRA.

Catch Up IRA Contributions. This means that if you are 50 or over you can contribute a total of 27000 per year into your 401k. The annual elective deferral limit for a 401k plan in 2022 is 20500.

Your total contribution including employer-matching funds cannot exceed 61000or 67500 for workers 50-plus. Get to your destination by making sure your retirement tank is full. Eligible participants may contribute up to double the deferral limit in effect ie.

A 401 k can be one of your best tools for creating a secure retirement. In tax years 2020 and 2021 those 50 and older can save an additional 1000 to their traditional or Roth IRA above and beyond the baseline 6000 annual limit for all eligible workers. For governmental 457b plans only.

What will my income be in retirement SIMPLE IRA or SIMPLE 401 k plans may also permit catch-up contributions up to 3000 in 2020 and 2021. Get to your destination by making sure your retirement tank is full. If you want to know how much you can put aside for retirement by investing your money over a period of time then our 401k Retirement Calculator can help.

However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to 27000. As you enter the information in each of these categories you will finds that our 401k Retirement Calculator updates the figures and gives you a final figure as you press Calculate. The TurboTax software is saying he contributed over the 18500 but it is less than the 6000.

In 2022 this catch-up contribution is 6500 meaning that those 50 and older can contribute a maximum of 27000 to their 401 k for that year. We show you top results so you can stop searching and start finding the answers you need. It provides you with two important advantages.

Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. My husband turned 50 in 2018. Up to 41000 in.

The IRA catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains 1000. The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. The 401k plan annual contribution limit is 20500 while the catch up contribution is 6500.

Catch-up contributions can help you do just. First all contributions and earnings to your 401 k are tax deferred. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Will this be corrected later. The catch-up contribution limit for employees aged 50 and over who participate in 401k 403b most 457 plans and the federal governments Thrift Savings Plan remains unchanged at 6500. CensiblyYours Custom Index Portfolios Retirement Planning Explained SECURE Act Tax Credit Calculator 401k Calculator 401k News and.

The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. This applies to 401k 403b most 457 plans and the. 401 k other than a SIMPLE 401 k.

Furthermore employer matching contributions paid into an eligible employees 401k cannot exceed the lesser of 100 of the employees compensation or 57000. Deferral limits for 401k plans are 19500 in 2020. The catch-up contribution for people age 50 and over remains the same additional 1000.

Ad Roll Over Existing IRA Accounts and Manage Your Fidelity Account Today. In 2022 this catch-up contribution is 6500 meaning that those 50 and older can contribute a maximum of 27000 to their 401 k for that year. Remember you have until April 15 2021 to contribute the maximum for 2020.

The catch-up contribution for people age 50 and over remains the same additional 1000. What kind of investments are. Catch-up contributions can help you do just that.

6000 in 2015 - 2019 may be permitted by these plans. Individuals who are age 50 or over at the end of the calendar year can make annual catch-up contributions. Dont Wait To Get Started.

TIAA Can Help You Create A Retirement Plan For Your Future. Annual catch-up contributions up to 6500 in 2022 6500 in 2021. 6 Take Advantage of 401k and IRA Catch-Up Contribution Limits.

Retirement Topics - Catch-Up Contributions. According to the IRS he can contribute 6000 for 401k catch up. If you already make the maximum contribution to.

If an employer chooses to match some or all of employee contributions those employer contributions do not count toward the elective deferral limit.

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Limits And Types

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

401k Tips For Beginners Financial Coach Saving For Retirement Retirement Savings Plan

15 Strategies For Quickly Expanding Your Business Growing Your Business Business Personal Finance

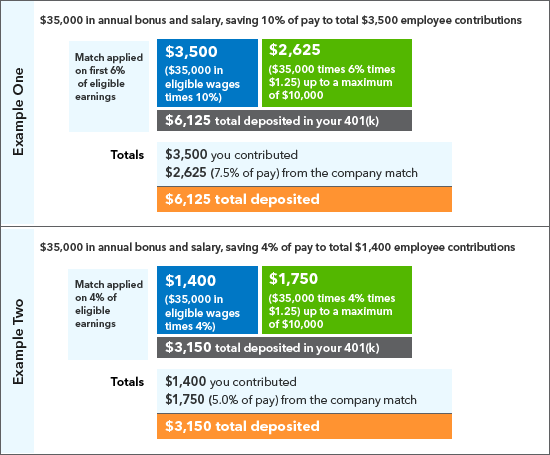

401 K Savings Plan Intuit Expert Benefits

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

The Best Retirement Plans To Build Your Nest Egg

Best Order Of Operations For Investing And Retirement The College Investor

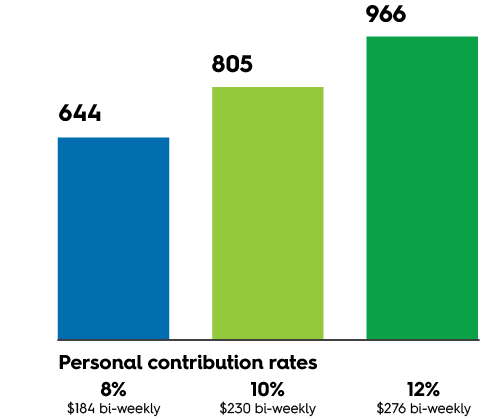

401 K Contributions How Much Is Enough Securian Financial

Best Retirement Calculator Retirement Calculator Retirement Income Saving For Retirement

How Much Can I Contribute To My Self Employed 401k Plan

5 Reasons A 401 K Is Better Than A Sep Ira

Retirement Tips Budgeting Money Money Saving Tips Money Management

Top 9 Reasons To Make 401 K Catch Up Contributions Bankrate

How Much Should I Have In My 401 K At 50

27 Retirement Savings Catch Up Strategies