Minimum withdrawal 401k calculator

Publication 590-B Distributions from Individual Retirement Arrangements IRAs Internal Revenue Service. The SECURE Act of 2019 changed the age that RMDs must begin.

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

The reports which will examine the period between February 2020 and the US.

. Required Minimum Distribution Calculator. Also unlike the Roth IRA it has required minimum distributions RMD at age 72 though at that stage. To make paperwork easier you can also have the taxes withheld from your distribution 10 will automatically be held for federal taxes if you choose this option but you can elect to have.

Understand the costs before you act. 401k Early Withdrawal Calculator. Use our RMD calculator to find out the required minimum distribution for your IRA.

Or you can use a calculator like this one from T. You can make a one-time also known as lump-sum withdrawal or a series of withdrawals or schedule automatic withdrawals. Early Withdrawal Costs Calculator.

You can start withdrawing funds from a 401k or IRA without penalty after age 59 12 but you dont have to start taking required minimum distributions RMDs from tax-deferred retirement accounts until age 72 70 12 if you reached age 70 12 before Jan. 401k required minimum distributions start at age 70 12 or 72. IRA FAQs - Distributions Withdrawals Internal Revenue Service.

Tax On A 401k Withdrawal After 65 Varies. This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year. 401k Withdrawal Rules.

Once you reach age 59½ you can withdraw funds from your Traditional IRA without restrictions or penalties. Use the Calculator Inherited IRAs. However you can take.

You die or become permanently disabled. While you still have to pay taxes on any money taken out of a 401k or IRA before a certain age there are some circumstances that would let you get around the 10 early withdrawal penalty for retirement funds. This is the amount of money that you must withdraw every year from the 401k account.

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. How To Calculate Required Minimum Distribution For An Ira. You can make a penalty-free withdrawal at any time during this period but if you had contributed pre-tax dollars to your Traditional IRA remember that your deductible contributions and earnings including dividends interest and capital gains will be taxed as ordinary income.

401K and other retirement plans. Exceptions to the Early Withdrawal Penalty. How to Rollover a 401K.

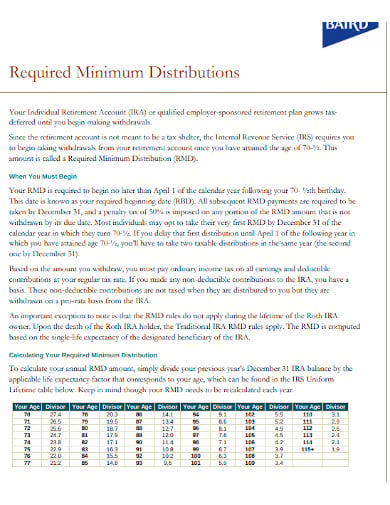

Rollover IRA401K Rollover Options. Whatever you take out of your 401k account is taxable income just as a regular paycheck would be when you contributed to the 401k your contributions were pre-tax and so you are taxed on withdrawals. If you were born on or after 711949 your first RMD will be for the year you turn 72.

We use the current total. So you might be able to avoid that 10 401k early withdrawal penalty by converting your 401k to an IRA. An RMD is the annual Required Minimum Distribution that you must start taking out of your.

Taking an early withdrawal from a 401k retirement account before age 59½ could have steep financial penalties. At age 72 federal law requires you withdraw a minimum amount from most retirement savings accounts. Early 401k withdrawals will result in a penalty.

If you withdraw money from your traditional IRA before age 59 12 theres a 10 early withdrawal penalty and that is in addition to the income tax due on each withdrawal. Regular investing does not ensure a profit or protect against loss. Interest Calculator Simple.

These are called required minimum distributions or RMDs There are some exceptions to these rules for 401k plans and other qualified plans. Hypothetical annual rates of return are not intended to reflect actual results. Or Choose A Retirement Calculator By The Question It Answers.

We account for the fact that those age 50 or over can make catch-up contributions. If your employer does not offer 401k loans they may still offer a 401k withdrawal. Your results may vary based on market conditions.

This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. Copy and paste this code into your website. If you return the cash to your IRA within 3 years you will not owe the tax payment.

You can avoid the early withdrawal penalty by waiting until at least age 59 12 to start taking distributions from your IRA. How much money do I need to retire. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

Individual retirement accounts have slightly different withdrawal rules from 401ks. On your Form 1040. Plus review your projected RMDs over 10 years and over your lifetime.

Exceptions for Both 401k and IRA. The IRS allows penalty-free withdrawals from retirement accounts after age 59 ½ and requires withdrawals after age 72. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

Your employer needs to offer a 401k plan. If you are an owner of an inherited IRA your distribution requirements depend on whether you were a. Yes you can withdraw more.

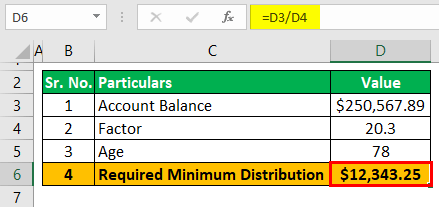

Retirement Plan and IRA Required Minimum Distributions FAQs. By pressing the calculate button we get two values. The calculator does not take certain factors into account including early withdrawal penalties required minimum distributions and holding periods.

Tax Deferred Investment Growth Calculator. Can I take more than the minimum IRA withdrawal after age 59 ½. Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors.

Present Value of Annuity Calculator. Rowe Price to estimate your distribution you must take a minimum amount but you can always take out more. We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and assume these numbers will grow with inflation over time.

Understand how to calculate when you have to take RMD withdrawals from your 401k. Once you turn age 59 12 you can withdraw any amount from your IRA. Required Minimum DistributionsCommon Questions About IRA Accounts Internal Revenue Service.

Use this calculator to help determine your withdrawal amount. Withdrawal in August 2021 have been done for weeks but are still going through review and declassification. The Costs of Early 401k Withdrawals.

For people under the age of 59½ a hardship withdrawal or early withdrawal from your 401k is allowed under special circumstances which are on the IRS Hardship Distributions pageUsing your 410k for a down payment on a principal residence is.

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

Retirement Withdrawal Calculator For Excel

An Easy To Understand Guide To Required Minimum Distributions Retirement Field Guide

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

What Is A Required Minimum Distribution Taylor Hoffman

Rmd Table Rules Requirements By Account Type

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

Rmd Table Rules Requirements By Account Type

Knowledge Base Required Minimum Distributions Rmd S Help Center Financial Planning Software Rightcapital

Required Minimum Distribution Calculator Estimate The Minimum Amount

Rmd Calculator Required Minimum Distributions Calculator

Required Minimum Distribution Calculator Estimate The Minimum Amount

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

Required Minimum Distribution Calculator Estimate The Minimum Amount

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates